CeramTec – The Ceramic Experts

With over 100 years of development and production experience, CeramTec holds a leading position worldwide in the manufacture of advanced ceramics and uses these materials in a wide range of applications. Today, our portfolio includes well over 10,000 different products, parts and components made of technical ceramics as well as a variety of ceramic materials. CeramTec employs around 3,800 people worldwide.

About Us

This great application diversity is possible thanks to advanced ceramics, also referred to as technical ceramics, engineering ceramics or industrial ceramics. These terms cover a variety of different and in part highly specialized ceramic materials with unique mechanical, electrical, thermal and biochemical properties and property combinations.

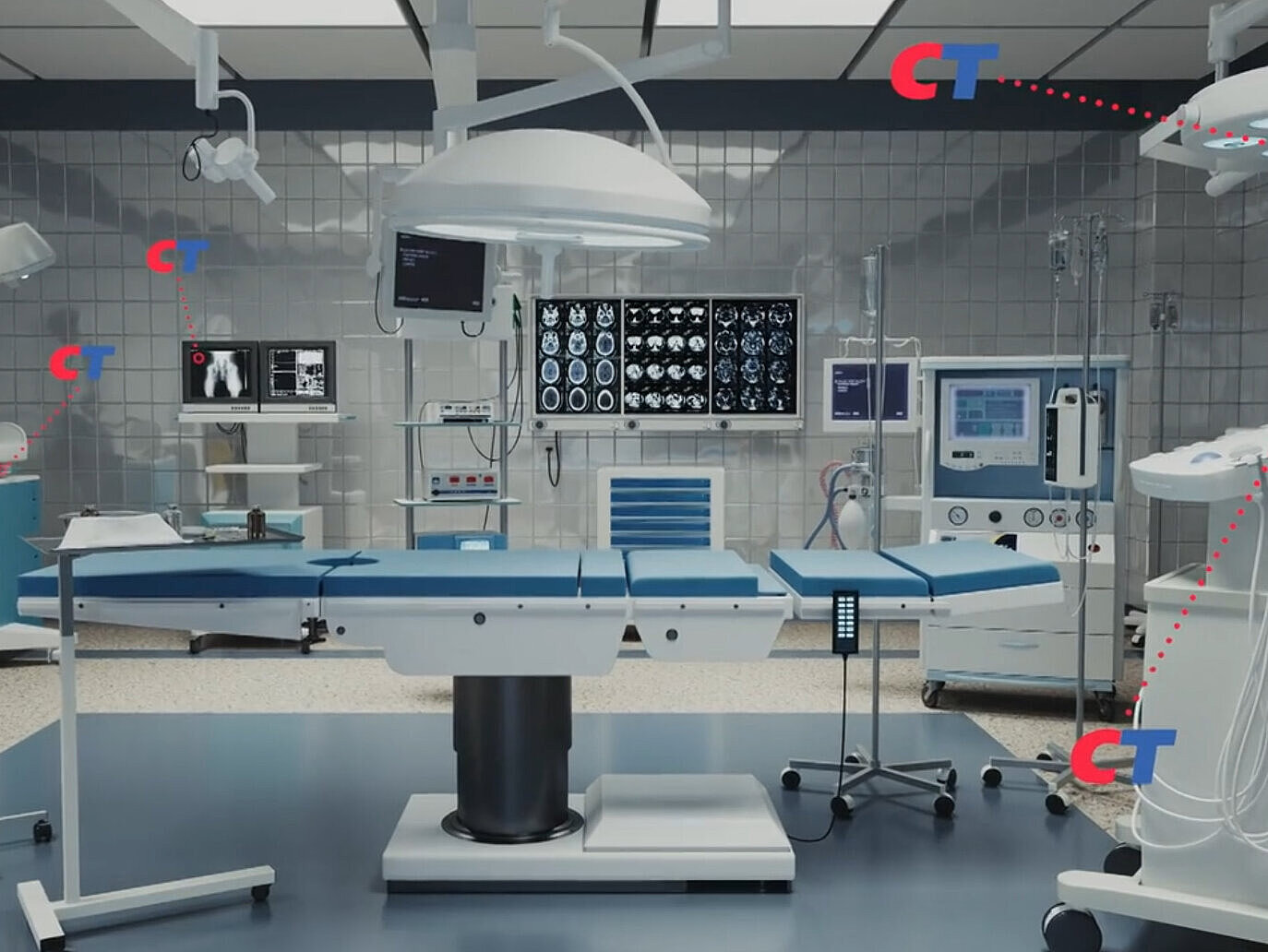

Advanced ceramics from CeramTec, as an international manufacturer and supplier, are used in Automotive, Mobility & eMobility | Cutting Tools | Electrical Engineering & Electronic Applications | Mechanical & Plant Engineering | Medical Technology and in many other applications. Correctly selecting the required ceramic materials, adjusting and adapting Advanced Ceramics to meet the respective requirements in the field of application, and optimally designing and manufacturing parts and components to take advantage of the special material properties of ceramics are core competencies of the ceramics experts and specialists at CeramTec.

With around 3,800 employees and production sites and subsidiaries in Europe, America and Asia, CeramTec as manufacturer and supplier has a worldwide presence.

Management

Dr Hadi Saleh was appointed Chief Executive Officer of the CeramTec Group on 8 March 2018 and has again been President Medical since November 2024. Eric Oellerer has been Chief Financial Officer (CFO) since 5 September 2018. Horst Garbrecht took over the position of President Industrial on 1 January 2022, completing the Management Board.